How Living Benefit Life Insurance Rescued David’s Retirement

David did not put enough away for retirement and was facing a retirement short-fall. The Tax-Free Pension Alternative, also known as living benefit life insurance or the Tax-Free IUL provided a rescue strategy to provide a tax-free retirement income David won’t outlive.

You can use this as a catch up solution if you have not put enough away for retirement. Qualified plans (IRAs, 401(k)s 403(b)s) have annual contribution limitations- see chart. There are no such limitations with the tax-free retirement plans. You can set up a tax-free IUL or tax-free pension alternative where you contribute $100,000 a year for 3 to 5 years or longer, so long as the insurance company will accept the amount you want to contribute.

Retirement Plans are heavily taxed. Did you know that if you withdraw $50,000 from you 401(k), the IRS could take $20,000? Did you know if you leave $500,000 in your 401(k) to your spouse or kids, the IRS could take $200,000? Living Benefit Life Insurance is a little known IRS strategy that the wealthiest top 10% of American Families, including the top 1% have been using for more than 20 years to cut taxes and preserve capital.

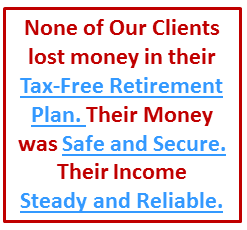

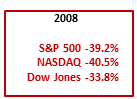

Tax-Free IULs are an IRS Alternative To 401(k) and 403(b) retirement plans with no downside risk.

• You don’t lose money when the markets go down!

• Share in Market Upside when Markets go up!

• Earn Reasonable Rates of Return!

• Gains Locked In Annually!

• Tax-Free Penalty Free Withdrawals at any age!

• Tax-Free Income You Won’t Outlive!

Contact us at 800-955-7898 for a personal illustration.